I re-authenticated my bank account for a second time, but even after this it didn't work. While I troubleshooted this, I had to manually add each of my transactions. However, even after it was set up, my transactions weren't regularly imported. I had to remove this security feature to import my transactions into the YNAB app.

I had it set up to enter a passcode for every login. This took me several days because I had difficulty importing information from my bank account.Īfter some back and forth with YNAB's customer service, we figured out that the issue was the security settings on my Bank of America account. Before you set up the mobile app, you had to set everything up on desktop. We have more cushion than we need in our account for household expenses, so it might be better to put more of that money toward retirement or paying down my student loans. Actually seeing the budget also showed me that we could be saving more. We plan to buy a house within a few years, so YNAB allowed me to see that these are two areas where we (or I) could curb spending and put that additional money toward a down payment.

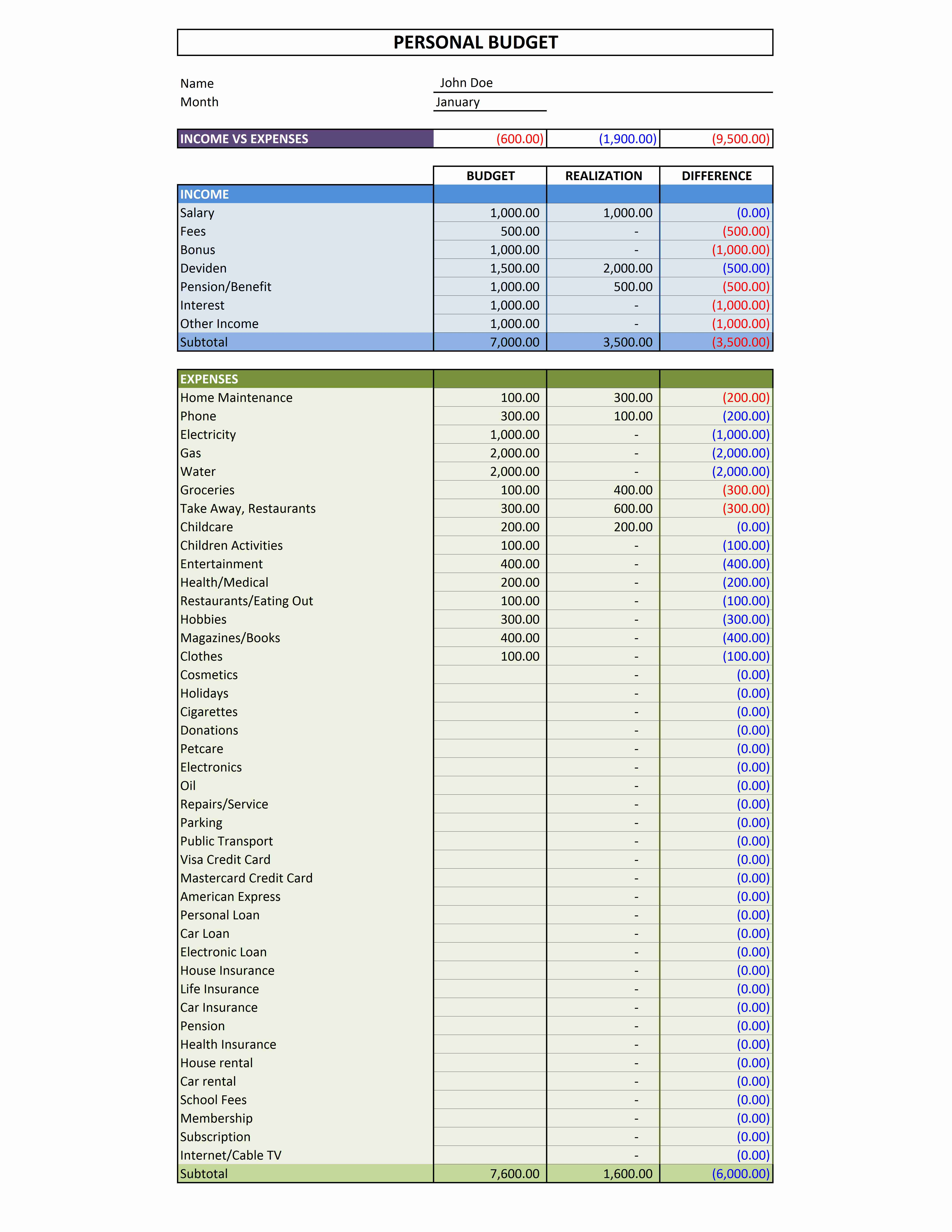

Using the tool allowed me to see that we spend less than $200 a month eating out, but that I need to keep a better eye on my discretionary spending for things like beauty and hair products and anything from (Amazon Prime admittedly has turned me into a shopping junkie). It was more like “we'll eat out no more than two times a week.” I also had no gauge of my own discretionary spending, since this money comes out of my personal account. For example, before using this app, I had no idea how much my husband and I spent each month dining out and we never really set aside a specific amount for this purpose. I do a good job of tracking our spending after the fact, but I could improve when it comes to setting aside money for specific purposes - basically being more financially proactive. During this process, I realized that I'm not as good a budgeter as I thought. You have to account for every dollar coming in, either using it to cover monthly household expenses, pay off debt, for dining out and for what YNAB calls “quality of life” expenses like vacation.

Zero-based budgeting is tough, but I can see its value. But it's best for people who want to get serious about how much they actual spend and where they may need to make sacrifices to achieve a larger goal. The app makes budgeting straightforward, allowing you to see how much over or under you are for a particular line item. Friends want to double date at that trendy new Italian restaurant? It may not be in your $200 dining out budget. Want to buy a new purse or pair of shoes? If your monthly clothing budget is $100, then you may not be able to afford it this month. The app is based on the premise of “giving every dollar a job,” meaning you budget for every expense - fixed, discretionary or otherwise. If you're ready to account for where every cent of your money goes, You Need a Budget could work for you.

0 kommentar(er)

0 kommentar(er)